ABC of Impact Investing

ABC of impact investing – a guide

There’s no doubt that impact investing is one of the biggest and fastest accelerating investment trends.

The Global Impact Investing Network, a non-profit organisation that promotes impact investments, estimates the market to be at least $715 billion,[1] which is up 42% on the $502billion a year earlier[2].

Environmental and social factors were previously much more of a sideline to meet the desires of a smaller proportion of people who cared about something other than just financial gain.

But today, investing for good strategies are far more in demand with far more focus on the companies – and investment opportunities – that promise a better world.

This ethos already exists in the way many people buy clothes, cars and even groceries.

They want to see that same impact ethos in the way they invest too.

If you’re new to the world of impact investing, here’s what you need to know:

What is impact investing?

Impact investments are made with the intention to generate positive, measurable social and environmental impact alongside a financial return.

Money is invested specifically in companies that are providing a solution to a problem for the planet or a community.

For example, you might invest in a company spending on wind and solar energy and committing vast sums for important development areas such as green hydrogen.

You might also support a housing association addressing diversity inequalities or helping unemployed tenants back into jobs.

It’s not uncommon for conversations on impact investing to be muddled with ethical investing as they both come under the “investing for good” banner.

But the two are very different.

What are the differences?

Ethical investments will screen out certain industries such as tobacco, alcohol and armaments, but the companies that are left may still have a negative impact on the planet or society.

Another style of investing sometimes talked about in the same breath as impact investing is known as ESG – standing for environmental, social and governance. Such investments take into consideration a company’s approach to ESG.

Ethical and ESG investing are only the first steps in the process in removing controversial industries and investing for good.

While ethical investing removes controversial industries and ESG focuses on how well a company is run, impact goes a step further.

Impact investing means that you will invest only into the companies that create a product or service that has a positive measurable social and or environmental impact.

Crucially, the impact will be aligned to the UN Sustainable Development Goals, which are a roadmap to achieving a better and more sustainable future for all.

They address a range of the most pressing global challenges, including poverty, inequality, climate change, and environmental degradation.

The benefits of impact investing

The benefits are wide-ranging.

Impact investing covers a huge range of areas under the environment and society banner and with the increasing number of investment choices today, you can choose investments based on personal values and preferences.

In other words, you can place your money behind the matters you feel most strongly about.

That brings the added feel-good factor that some positive change is happening which will improve lives of many.

As well as supporting crucial change, investing in companies that take sustainability seriously can also boost your returns.

For example, a BlueSphere Balanced Portfolio offers a balanced risk portfolio that contains a list of impact funds.

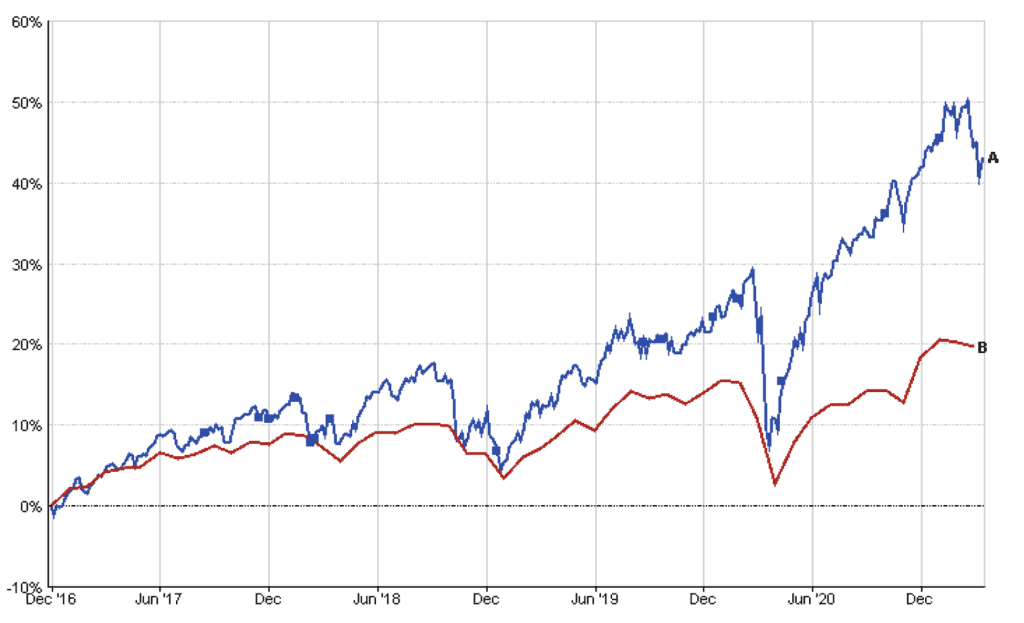

It has returned over 43% since the end of December 16 compared with 20% returned by similar funds.

- BlueSphere Balanced

- ARC Sterling Balanced

Looking more broadly, the FTSE4Good index of ethical stocks has beaten the FTSE 100 index of leading UK stocks over one, three and five and ten years.

The MSCI World SRI Index for socially responsible funds, has beaten the MSCI World Index over the same periods.

Not all of the stocks in these indices are impactful, however. Some stocks are classed as ethical or ESG. But the trend is clear – sustainability counts.

How to invest

Using your pensions and ISAs you can invest in funds that back companies that are driving change for a more sustainable world.

The requirements for a company to “qualify” as an impact investment means a much stricter selection of companies than, say, an ESG approach.

For example British American Tobacco has been included in the FTSE 100 top 5 highest rated ESG companies.[3]

But a company like this just wouldn’t make it into an impact investing portfolio because while it may have strong ESG scores, the products it manufactures still have significant detrimental health implications.

However, there are many opportunities within the impact realm. Opportunities are global as impact investments can be made in both developed markets such as the UK as well as emerging markets – in the Far East, for example.

Rather than selecting the individual companies in which to invest, you can use funds that are dedicated to impact investing.

There are broad funds that look to cover a wide range of issues, and more targeted funds that may look just to seek opportunities within one theme.

For example, investing only in companies that are contributing to the decarbonisation of the world economy.

Working with your BlueSphere adviser you can construct a portfolio of funds and companies that have the power to change the world for future generations and create financial security for your own future.

[1] https://thegiin.org/research/publication/impinv-survey-2020

[2] https://thegiin.org/research/publication/impinv-survey-2019

[3] https://www.hl.co.uk/news/articles/ftse-100-the-5-highest-esg-rated-companies

Why Switch To An Ethical Pension?

Why Switch to an Ethical Pension? Why [...]

How Do Investments Grow In Value?

How Do Investments Grow In Value? An [...]

Why Use An Ethical IFA?

Why Use An Ethical IFA? An ethical [...]

Energy Loan – All You Need To Know

Energy Loan - All You Need To Know [...]

How To Go Green With An Ethical Pension

How To Go Green With An Ethical Pension [...]

A Guide To Finance Terms

A Guide To Finance Terms Investing shouldn't [...]